Why is it essential to think about 3 Questions and do some research before you invest in Precious Metals like Gold, Silver, Platinum, Titanium etc

Investing can be tricky. Depending on what commodity or security you buy or sell, attributes are inherent to that transaction that could make your trade uniquely different from some other investment.

That means, in many cases, you have to ask yourself specific questions before you start investing or trading to ensure you enjoy the best possible experience.

In the case of investing or trading precious metals, like Gold, Silver, Platinum etc., there are at least three things you absolutely must know before you get started.

Keep an investing Journal to be on top of your investments.

It is a good idea to keep an investing journal where you not only handle bookkeeping duties tied to your precious metal investing but also list your detailed answers to the following questions and refer to this information frequently. Ask yourself these questions and answer them.

Why Am I Investing in Precious Metals?

Some people like the “cool” factor of buying precious metals. They may occasionally buy a little gold or silver; these people carry gold or silver coins wherever they go. They like showing their metal to their friends, and they are getting involved.

Is Precious Metal buying more as a hobby than a means to trade a commodity or in the hopes of realizing a profit? Most folks who buy and sell precious metals, in either paper or physical form, do so for several reasons. They want to

a) realize a profit at some point in time and

b) they are purchasing a hedge against an economic collapse.

You may purchase precious metals as a retirement fund vehicle to have a rare and valuable commodity to pass along to your children or grandchildren.

Whatever your reasons, make sure you are crystal clear on why you invest in precious metals.

What Precious Metals Will I Buy?

In 2020, one Troy ounce of .999 fine gold sold for nearly +/- U$1,800. If you purchased a gold bar, as you see in the movies, that is 400 ounces. Your investment would be around U$480,000 plus whatever premium you pay for one brick.

In 2020, you could still purchase an ounce of silver for less than U$ 30 in many cases. Money may be a consideration when you choose which precious metals you will buy.

In 2023 silver 1oz fine silver bar 999. cost around +/- U$ 43.84

Gold and silver are the most commonly traded precious metals, so you can always unload your physical or paper investments in a reasonable amount of time.

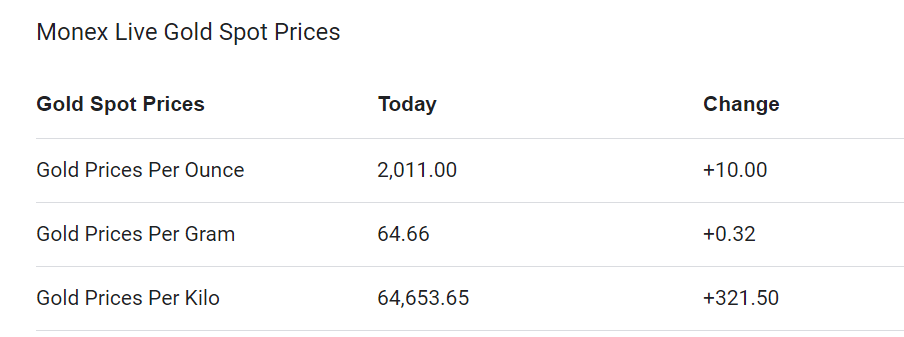

Image Sources: FastMarkets, ICE Benchmark Administration, Thomson Reuters, World Gold Council; Disclaimer

Platinum and Palladium are other precious metals traded on stock exchanges, and you can purchase physical palladium and platinum products.

Moving platinum and palladium investments, physical bars or ETF shares may be more challenging than trading gold and silver. Consider these considerations when deciding what precious metals you will be buying.

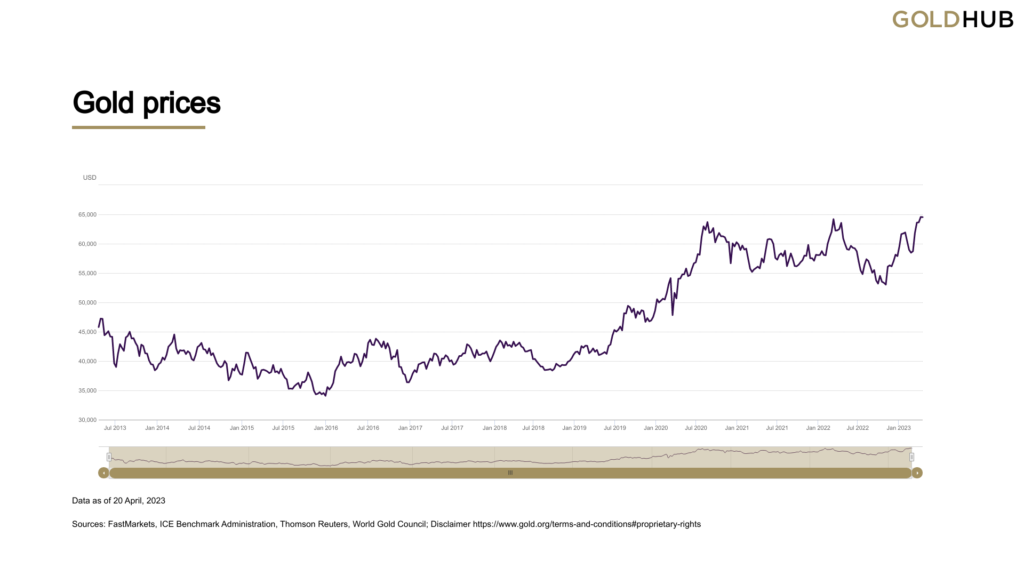

Look at this chart from the last 10 years of how Gold Prices have developed. Credit to the Image Source.

Sources: FastMarkets, ICE Benchmark Administration, Thomson Reuters, World Gold Council; Disclaimer

This is the last Question you should ask yourself. Where Will I Store My Precious Metals?

If the hobbyist example mentioned earlier suits, storage might be acceptable. Always consider keeping it safe, and if the value is getting into 4 figures, go and get insurance for it.

You may want to show off your precious metal collection, and you will only need part of the room to hold the precious metal bullion and coins you will be purchasing.

If you plan on making a sizable investment over time or want the safest possible storage, consider renting your dealer’s depository storage space.

You can purchase a safe you keep at your home or business. There is no end to the number of in-floor, in-wall, and standalone safes which offer fire protection and other security benefits.

You may also talk to your banker about renting a safety deposit box, which usually means you have limited storage space.

You will also need to consider the value of the insured amount of the safety deposit box.

These are just three essential questions you should ask yourself before investing in precious metals. Review your answers over time.

Your ideas about investing change over time, and how you answer these crucial precious metal investing questions may also change over the years.

Conclusion:

The best way to invest in Precious Metal is with a company that does it for a living, with good Ratings from the financial sector.

You might pay a fee for the storage, but you know it will be safe.

Do click here if you want to get some information on your precious metal investment.